For those building a unicorn on a cup-noodle budget.

👋 Welcome to The Ramen Hustle, your weekly newsletter serving up hot, scrappy business ideas, helping you go from zero to side hustle. The only rule? Don’t just read it. Steal it.

In today’s episode:

💰 Be the master of unlocking capital

📱 The best AI Agent in your pocket

⬆️ Demand for freelance talent is on the rise

🚽 The best bathroom break ever

🤝 To co-found or not, that is the question

THE FRESH IDEA

Business Credit Card Consulting

Be the go-to person business owners call when they need to unlock $100k–$200k for ads, inventory, or receivables with 0% APR for 12–18 months. Choose one niche you actually care about—ecom brands, dental practices, home-service rollups, indie gyms—and help them with business card approvals.

Your pitch is simple: no win, no fee. You only get paid when you unlock funding. 🚀

💼 Most small businesses don’t know how to stack issuer promos, manage utilization by card, or time applications across Chase, Amex, U.S. Bank, and BoA. You bring the map: entity setup hygiene, bank relationship play, application order, and a calendar for promo end-dates and refinances.

Success fee structured in one of two ways:

5–10% of approved promo limits in your niche, or

1–2% of the amounts actually drawn during the promo period.

Outreach Engine: Build a small but durable network

Warm CPAs and bookkeepers who see clients starving for working capital.

Local bankers/relationship managers who aren’t able to help founders

Niche communities: ecom Slack groups, dental FB groups, franchise forums, indie gym owners.

Lead magnet: a one-page “0% Runway Planner” with a funding calculator and promo schedule. Host a 30-minute monthly Zoom for your niche with live Q&A. Post one case study per month with real numbers. 📈

Real examples: A real-estate pro (“Yammy”) secured $160k for marketing and Airbnb arbitrage. A crypto-services owner (“Boon”) landed $135k to bridge six-month receivables and cover payroll. With no upfront cost and 0% APR promos, the 5% commission is a no-brainer.

✈️ Plus, points stack on top.

Rate this hustle:

HUSTLE TOOL

A Framework for Smarter Voice AI Decisions

Deploying Voice AI doesn’t have to rely on guesswork.

This guide introduces the BELL Framework — a structured approach used by enterprises to reduce risk, validate logic, optimize latency, and ensure reliable performance across every call flow.

Learn how a lifecycle approach helps teams deploy faster, improve accuracy, and maintain predictable operations at scale.

HOLIDAY HUSTLE

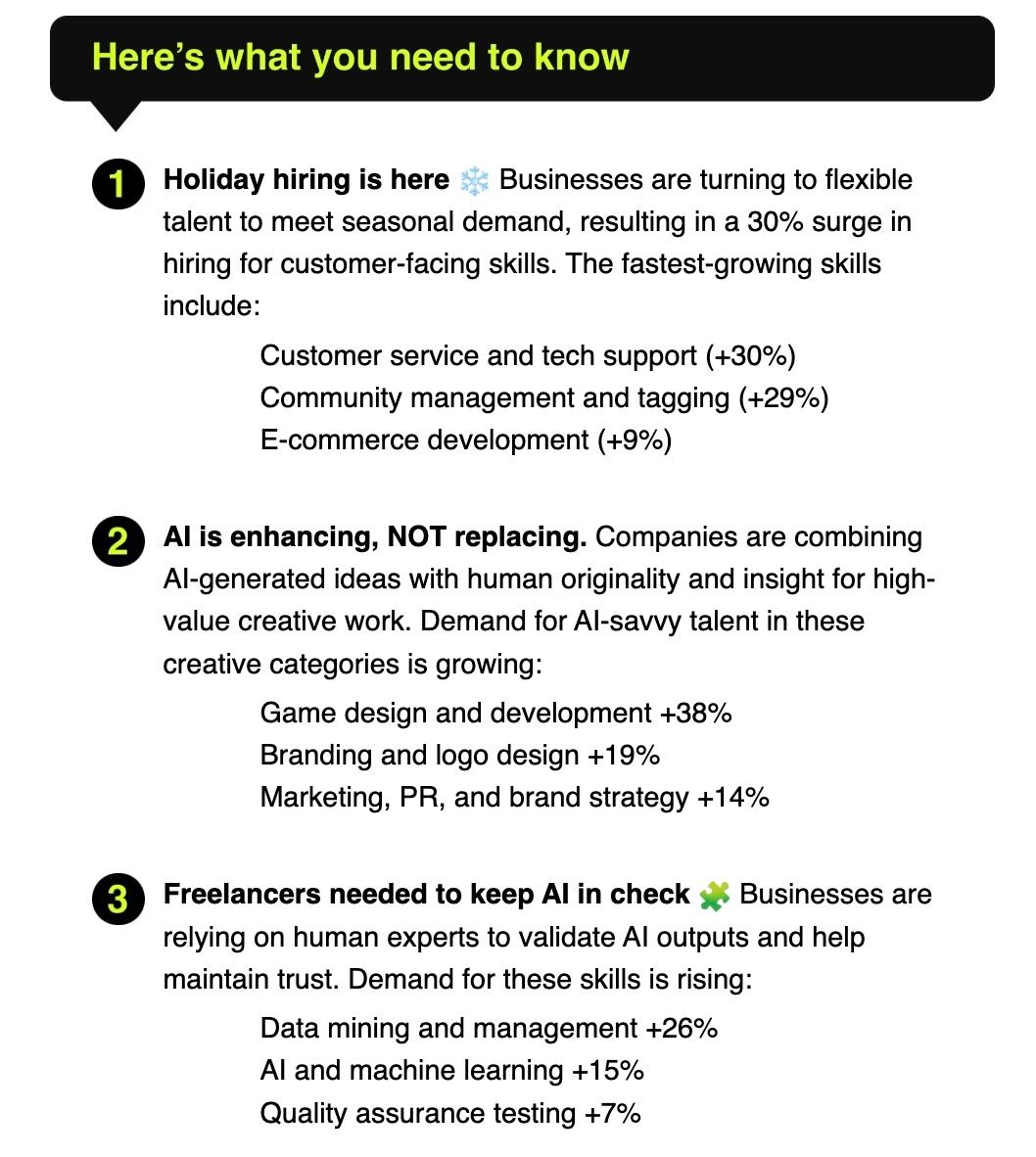

The Upwork Monthly Hiring Report is the most up-to-date snapshot of the hiring landscape. See what skills clients are looking for. Use these insights to optimize your profile, strengthen proposals, and win more work.

Demand for freelance talent is on the rise. 📈

❄️ While seasonal hiring isn’t a new concept, there’s a unique interest in support from independent talent this year — with 78% of businesses planning to hire flexible talent in the next three months. This marks the highest interest in flexible hiring through all of 2025, and is a strong sign of growth for the freelance economy that already generates an estimated $1.5 trillion in annual earnings.

HUSTLE AUTOPSY

Portable Wedding Restrooms

Here’s a premium twist on an unglamorous need. 🧻 Outdoor venues, barns, vineyards, and backyard weddings all require clean, reliable facilities that match the event’s aesthetic. Instead of plastic porta-potties, you rent luxury restroom trailers with climate control, flushing toilets, running water, and vanity lighting.

👰🏼♀️ Couples pay for guest comfort and photography-friendly interiors. Typical pricing ranges from $1,200 to $3,500 per weekend per trailer depending on size, delivery distance, and on-site attendant service. One or two units can handle most 100–200 guest weddings; larger events may need multiple stalls and ADA options. ✨

The play is straightforward. Finance or lease one trailer, a capable truck, and a service plan for pumping and sanitizing. Build venue relationships first; preferred-vendor lists at barns and vineyards can fill a calendar fast. Offer white-glove touches like fresh florals, vanity kits, and uniformed attendants for an upsell. 🚚

Market with polished photos, a 30-second walkthrough video, and a “date checker” on your site. With 30–40 booked weekends a year at mid-tier rates, a single trailer can gross six figures, while you expand into additional units, shower trailers, or festival contracts.

It’s a practical, high-margin service where comfort meets class—and couples will happily pay for both. 💍

STARTUP ANALYSIS

Bringing In a Cofounder: Yes, No, or Not Yet

A lot of people think “real” startups need a cofounder. 🤝 They see the duos on TechCrunch and start looking for their own Steve Wozniak. But bringing in a cofounder is less like hiring help and more like getting married 💍—easy to start, hard (and expensive) to undo.

In the early days, default to solo if you can. 🧑🚀 If the business is still an experiment, you’re validating the problem, or you’re not even sure you want to do this for the next 5 years, you probably don’t need a cofounder. Giving away half your company to help you “stay motivated” or “feel legit” is usually just very expensive therapy. 🛋️

Start looking for a cofounder when you’ve hit a ceiling you can’t realistically climb alone. ⛰️ For example: demand is outpacing your capacity, and you’re repeatedly blocked by the same missing skill set (engineering, sales, operations). Or you’re staring at a bigger opportunity (new product, new market) that clearly requires a second brain and network at your level—not just another pair of hands.

If you do bring someone in, don’t decide based on vibes at a coffee shop. ☕ Work on a small, real project together first. See how they handle stress, slow weeks, money conversations, and feedback.

👍🏻 Co-founders with successful companies

Larry Page & Sergey Brin – Google

Patrick & John Collison – Stripe

Ben Cohen & Jerry Greenfield – Ben & Jerry’s

👎🏼 Co-founders with UN-successful companies

Henry Dashwood & Jamie Rumbelow – Tract

Garry Tan & Sachin Agarwal – Posterous

Lauren Kay & Emma Tessler – Dating Ring

THE RAMEN HUSTLE VIP INVITATION

Here’s an un-boring way to invest that billionaires have quietly leveraged for decades

If you have enough money that you think about buckets for your capital…

Ever invest in something you know will have low returns—just for the sake of diversifying?

CDs… Bonds… REITs… :(

Sure, these “boring” investments have some merits. But you probably overlooked one historically exclusive asset class:

It’s been famously leveraged by billionaires like Bezos and Gates, but just never been widely accessible until now.

It outpaced the S&P 500 (!) overall WITH low correlation to stocks, 1995 to 2025.*

It’s not private equity or real estate. Surprisingly, it’s postwar and contemporary art.

And since 2019, over 70,000 people have started investing in SHARES of artworks featuring legends like Banksy, Basquiat, and Picasso through a platform called Masterworks.

23 exits to date

$1,245,000,000+ invested

Annualized net returns like 17.6%, 17.8%, and 21.5%

My subscribers can SKIP their waitlist and invest in blue-chip art.

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

QUICK SIPS

📚 Must-Read: Demand is up, turnover down for unglamorous work

📈 Trending Story: Jeff Bezos is back in the CEO seat

💬 Founders Story: From cheap bookcases to Swedish meatballs